In the second quarter of 2021, the United States, South Korea, the European Union, and Japan announced new semiconductor strategies, while China’s semiconductor plan was still in preparation. According to initial estimates, over the next five to ten years, global investments in the semiconductor industry will total at least $1.5 trillion. Notably, based on past semiconductor trends, major industry booms are often followed by significant downturns, so semiconductor companies must remain cautious about expanding production. In recent years, the global semiconductor supply chain has faced immense challenges—COVID-19 and international trade disputes severely disrupted the global supply chain, revealing flaws in national supply chains. In response, governments have shifted focus to “internal circulation,” with a semiconductor competition centered on "improving internal capabilities" now underway.

Semiconductor Strategic Plans Worldwide:The global semiconductor industry has entered a new phase, where the focus has shifted from economic global cooperation to the construction of a complete semiconductor supply chain.

United States "Semiconductor Incentive Program" – $52 billion investment

On May 11, 2021, 64 companies formed the U.S. Semiconductor Alliance (SIAC) and urged Congress to approve the $52 billion "Semiconductor Incentive Program." The program aims to significantly enhance U.S. chip production and research capabilities within five years, including $39 billion for production and R&D, $10.5 billion for project implementation, and $1.5 billion for emergency financing.

South Korea "K-Semiconductor Strategy" – $510 trillion won investment over 10 years

On May 13, 2021, South Korea announced the "K-Semiconductor Strategy" with a massive $510 trillion won investment by 2030. The initiative, which aims to lead the global semiconductor supply chain, will involve public-private collaborations, with tax incentives, financial support, and talent development at its core.

EU "2030 Digital Compass" Plan – Production of 20% of global high-end semiconductors

In response to the pandemic, the EU launched the "2030 Digital Compass" plan to reduce dependence on U.S. and Chinese tech. The plan includes a €50 billion ($38.6 billion) investment to create a robust semiconductor ecosystem in Europe and aims to produce 20% of the world's cutting-edge semiconductors by 2030.

Japan’s Semiconductor Digital Industry Strategy

Japan’s Ministry of Economy, Trade, and Industry (METI) outlined its "Semiconductor Digital Industry Strategy" on June 4, 2021, emphasizing global cooperation in semiconductor manufacturing, with a focus on digital investments, advanced logic design, and strengthening domestic industry resilience.

China’s "Chip Confrontation" Plan – $1 trillion investment?

China is reportedly preparing a massive $1 trillion semiconductor investment plan, led by Vice Premier Liu He, designed to help local chip manufacturers overcome U.S. sanctions. This plan could connect with China's "2030 Plan" and the "14th Five-Year Plan," which highlight third-generation semiconductor development as a priority. China has already made significant strides with large-scale investment in its integrated circuit industry, such as the establishment of the National Integrated Circuit Industry Investment Fund, which has provided billions for manufacturing, design, and equipment.

Caution on Semiconductor Investments and Expansion

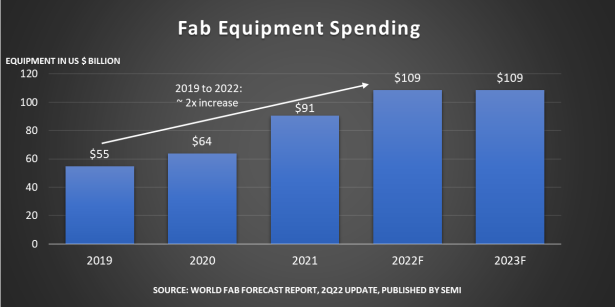

While countries push forward with strategic plans, semiconductor companies must exercise caution. SEMI forecasts 29 new semiconductor fabs to be built by 2022, with over $140 billion in equipment spending. However, the semiconductor industry is cyclical, and past data shows that industry booms often precede downturns. This pattern demands careful investment and capacity expansion strategies, particularly when new projects come online, as investments must be weighed for long-term returns.

Conclusion: Global Collaboration for Win-Win Outcomes

Despite strong national efforts, the semiconductor industry is deeply intertwined, with the production process spanning multiple countries and regions. As the U.S. leads in design, Taiwan and South Korea set manufacturing benchmarks, and China boasts the world’s largest semiconductor market, but faces significant manufacturing gaps. For global success in the semiconductor industry, it will require joint efforts across all regions, combining capital, technology, and expertise.