Recently, our company awarded commemorative medals to cornerstone employees who have completed 3, 5, and 10 years of service, in recognition of their years of dedication and contribution.The commemorative medal awarding ceremony began in 2021. Depending on the service period (3, 5, or 10 years), the medals feature pure gold and silver coins mounted on crystal bases. The front of the medal is engraved with the year and a wheat ear pattern, symbolizing the legacy of the cornerstone employees who have made significant contributions, as well as cooperation, prosperity, and eternity. The medals are highly valuable for collection and remembrance.These commemorative medals serve as a special tribute to the journey of each employee, acknowledging the efforts of many who have worked diligently, innovatively, and contributed to the high-quality development of Kejian Electronics. The initiative also plays a key role in enhancing employees' sense of honor, belonging, and cohesion. The company encourages new employees to carry forward the traditions and work ethic of their predecessors, accelerating the pace of progress. The company hopes that they will take pride in Kejian today, so that Kejian will take pride in them tomorrow.

Full of the vibrant colors of life's smoke and fire, leisurely observing the passage of time in all things.Life is about finding moments of peace amidst busyness, discovering little joys in the ordinary!This is dedicated to the 'Dongyunhe Camping Activity' held by Yueqing Kejian Electronics Co., Ltd. on October 28, 2022.

Under the long-term suppression of the COVID-19 pandemic, offline services have been significantly impacted, while the online digital industry has embraced development opportunities. Among them, the innovation, competition, and market prospects of digital technology are at an unprecedented level. Among many digital technologies, the "metaverse" stands out for its ability to attract investment.According to McKinsey's latest report, "Value Creation in the Virtual World," global interest in the metaverse's vertical sectors surged in 2022, with Web3 investment news and new NFT product lines being launched almost every week. By early July, over $120 billion had been invested in the metaverse, more than twice the $57 billion investment in 2021.This article will explore how the semiconductor industry can leverage the "metaverse" as a double-edged sword, focusing on technological innovation, industrial development, and application expansion.Is the end of AI AIoT, and the end of the internet the metaverse? The concept of the metaverse first appeared in 1992 in Neal Stephenson’s science fiction novel Snow Crash. The novel describes a virtual digital world "Metaverse" parallel to the real world, where people use VR devices to create avatars and live in the virtual world. This concept became popular in later novels and films.Even today, the metaverse lacks a unified and clear definition, but there are common elements that help understand this popular concept.The most widely accepted is Roblox’s "8 Essential Elements of the Metaverse": Identity, Friends, Immersion, Low Latency, Diversity, Ubiquity, Economic System, and Civilization. Roblox, the world’s largest multiplayer online creation platform, went public in the US on March 11, 2021, and is considered the "first stock of the metaverse."Facebook founder Mark Zuckerberg likens the metaverse to an internet that humans can “immerse themselves in” rather than just “watch and use” (UGC ecosystem), not just the next generation of the internet but the ultimate one. On October 28, 2021, Facebook changed its name to Meta, fully investing in the metaverse and sparking the "metaverse boom" among major tech giants, becoming the catalyst for the metaverse economy’s explosion.In the "2022 China Metaverse White Paper," the metaverse is defined as a digital world created by people using computers, parallel to the real world. It refines the "four core features of the metaverse" (Figure 1): Immersive experience, Virtual identity, Virtual economy, and Virtual social governance. This report, released in May 2022, is the most authoritative and comprehensive metaverse report in China.Although there are many valuable viewpoints in the global debate, it can be summarized that the future of the metaverse should encompass keywords like "virtual and real integration, immersive experience, ecological closed loop, natural interaction, parallel execution, and the Internet of Everything."Another hot topic is whether the metaverse is the future of the internet. The radicals believe that the metaverse is the next generation of mobile computing platforms (such as VR/AR/XR devices) that will create an entirely new internet ecosystem, with 5 billion users expected by 2030. Gradualists argue that the metaverse is not the next generation of the internet; it is a new application that will emerge once technology reaches a certain level and will be the largest application scenario in the third generation of the internet, following the PC and mobile internet.Interestingly, different countries and regions have different attitudes toward the metaverse, divided into radical and cautious factions. Countries like South Korea, Japan, and India are in the radical camp, while the U.S., Europe, and China are more cautious or wait-and-see.Attitudes Toward the Metaverse's Prospects in Different Countries The South Korean government reacted quickly to the metaverse, setting up a metaverse association and aiming to take a leading role in the industry. According to the five-year "Metaverse Seoul Basic Plan," the metaverse platform "Metaverse Seoul" is expected to be completed by the end of 2022.Japan aims to foster metaverse-related industries and build new national advantages. The Ministry of Economy, Trade, and Industry published a report in July 2021 defining the metaverse as "a virtual space where producers from various fields provide services and content to consumers."India is one of the top countries in the world for metaverse investment, with major tech companies like Reliance Industries, which launched "Jio Glass" for students and teachers to access 3D virtual classrooms.In contrast, developed countries like the U.S. remain cautious. The U.S. government has not yet released an official metaverse policy, with concerns over data security and monopolistic risks taking precedence. Europe is also highly cautious, with the EU focusing on regulations to gain a first-mover advantage in governance.China, on the other hand, has been more lenient with new technologies and is allowing space for the metaverse to grow. Currently, there is no official metaverse policy, although articles, such as one from the Central Commission for Discipline Inspection in December 2021, view the metaverse as a combination and upgrade of existing technologies, likening it to a "3D version of the internet."Strategies of Major Tech Companies Under varying national attitudes, global tech companies also show similar and divergent approaches toward the metaverse.The commonality is that tech giants are primarily focused on expanding capabilities in VR/AR hardware, 3D game engines, and content creation platforms. While the specific choices vary, the sub-sectors are quite similar with no major new applications emerging yet. The differences arise from the companies’ stances on the metaverse, with "radical" and "gradual" factions."Radical" companies include Roblox, Meta, Microsoft, Google, Nvidia, Baidu, NetEase, etc. These companies, mostly large American enterprises, are investing heavily in the metaverse, with some already launching metaverse-related products.For example, NetEase unveiled its next-gen internet technology architecture for the metaverse in December 2021, releasing its virtual human SDK "Youling" and immersive event system "Yaotai," showcasing their metaverse muscles. Similarly, Baidu launched "Xirang," an immersive virtual space parallel to the physical world, as part of its metaverse project initiated in December 2020."Gradual" companies like Tencent, ByteDance, and Alibaba have not officially announced major metaverse layouts but are quietly making moves in metaverse sub-sectors.Currently, Tencent is focusing on three main areas: underlying infrastructure, backend architecture, and content & scenarios. It is investing in Epic Games and Snap to establish a strong position in the VR/AR ecosystem. Alibaba has invested heavily in Sandbox and established a metaverse lab within Alibaba DAMO Academy to explore four layers of the metaverse: holographic construction, 3D simulation, virtual-real integration, and linking the virtual with the real. ByteDance, the parent company of TikTok, has also entered the metaverse through acquisitions, including purchasing VR headset maker Pico for 9 billion yuan.Analyzing the Metaverse Industry Chain From a technological evolution perspective, the metaverse needs to go through three development stages: Digital Twin, Digital Native, and Virtual-Real Symbiosis. Currently, it is still in its early stage, with VR and AR devices serving as initial mediums. Accelerating the speed of metaverse technology development requires the collective strength of the entire industry chain.The metaverse industry chain has already gathered a wide range of upstream, midstream, and downstream companies.Upstream: Core Technologies Core technologies include hardware components, foundational software, and network technologies. Hardware component industries such as core chips, optical devices, displays, and sensors will directly affect the autonomy of domestic terminal industries. For example, GPUs, MCUs, and sensors must improve performance to meet the algorithm requirements of the metaverse.Midstream: Platform Technologies The metaverse requires platform technology companies that provide essential services to the application ecosystem. These companies are categorized into three main areas: digital twins, creative tools, and IT support platforms.Downstream: Products and Ecosystem The downstream sector of the metaverse industry is diverse, including XR devices, interactive technologies, and simulation. These products, along with games, social media, advertising, and other sectors, will drive the metaverse forward.Chinese Semiconductor Companies' Involvement in the Metaverse Chinese semiconductor companies are playing a key role in the metaverse’s development, as evidenced by the "2022 Hurun China Metaverse Potential Companies List." Of the 220 companies on the list, 36 (16%) are semiconductor-focused, second only to software and data services (17%) and media & entertainment (17%).The AR/VR chip sector, which is essential for the metaverse, includes companies like MediaTek, Airoha Electronics, Beijing Junzheng, Rockchip, Allwinner Technology, and Chipone Technology, showing that Chinese semiconductor firms are making strides in the AR/VR applications that power the metaverse.The optical, display, and interaction technologies—key components for metaverse devices—are also being developed by prominent Chinese companies like Leyard, OFILM, Sunny Optical, and BOE. These companies are focused on providing a complete set of solutions to drive the rapid development of metaverse applications.Lastly, in the semiconductor and electronic component sectors, companies are deeply developing specific chip technologies and expanding product lines to provide solutions for the innovation and application of metaverse products.

At the end of September 2022, Kejian Electronics conducted its second fire drill of the year.Smoke bombs created a more realistic environment, and with the sound of the fire alarm, employees covered their noses and crouched down. They evacuated in an orderly fashion along the walls to an open area.Each employee was required to practice using a fire extinguisher. The drill concluded with a summary from the drill leader, Mr. Zhang, who reinforced the importance of fire extinguisher classification, usage, and fire drill procedures.Lead Coordinator: Zhang LongjunMaterials Prepared by: Zhou Hong and DengAssisted by: Management Department

Warmly welcome all new colleagues to join us! We also welcome our valued customers and friends to consult and negotiate with us!

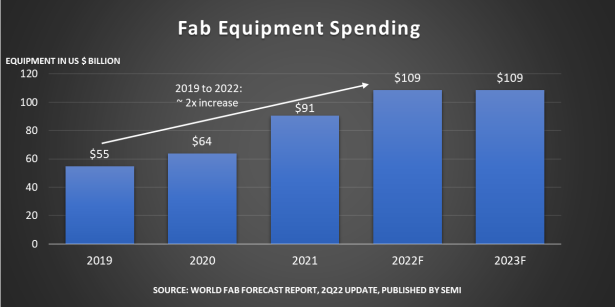

Currently, some of the downstream market demands are reaching saturation, but the overall trend is still quite positive.On a higher level, SEMI, in its latest World Fab Forecast report, provides data showing that the investment in front-end manufacturing equipment for fabs is expected to reach $109 billion in 2022, setting a new historical record and the first time surpassing $100 billion. The year-on-year growth for 2022 is 20%, which, although slightly lower than the 42% increase in 2021, still suggests that 2022 will mark three consecutive years of rapid growth.SEMI President and CEO Ajit Manocha stated, "This record-breaking investment underscores the unprecedented and sustained growth in the industry," highlighting the significance of the $109 billion forecast. By examining data from SEMI, Gartner, and Counterpoint Research, we can better understand the current state of the semiconductor manufacturing (including foundries) market, which is helpful for predicting the future direction of the industry.Manufacturing equipment investments continue to rise, with Taiwan leading Focusing on semiconductor manufacturing equipment, SEMI’s report mentions that global fab equipment facilities will expand by 8% this year, compared to a 7% growth rate last year. SEMI expects the fab equipment market capacity to continue growing in 2023, with a projected growth of about 6%.The last time an 8% year-over-year increase occurred was in 2010, when wafer monthly capacity reached 16 million units (equivalent to 200mm wafers). It is expected that by 2023, this figure will rise to 29 million wafers per month. In 2022, 85% of the spending on semiconductor manufacturing equipment will come from the capacity expansion of 158 fab plants and production lines.Regionally, Taiwan will remain the largest spender on fab manufacturing equipment, with an investment of $34 billion, a 52% year-on-year growth. Following Taiwan is South Korea, with a 7% increase, totaling $25.5 billion. Mainland China, ranking third, is expected to see a 14% decline in fab equipment investment, totaling $17 billion, which is largely due to a significant drop following last year’s high growth.Meanwhile, investments in Europe and the Middle East will reach a record $9.3 billion, an increase of 176%. The Americas are projected to see 13% and 19% growth in fab equipment investment for 2022 and 2023, respectively, reaching around $9.3 billion in 2023. SEMI forecasts favorable growth in Taiwan, South Korea, and Southeast Asia in 2023.Top 10 Foundries The investments in manufacturing equipment are predictable by region. In a recent semiconductor industry report by Gartner, the top 10 foundries in terms of revenue for 2021 were listed, though this doesn't cover the entire semiconductor manufacturing industry, it still provides a clear reflection of the current market status.The top 10 foundries by revenue included TSMC, Samsung, UMC, GlobalFoundries, SMIC, PSMC, Shanghai Huahong Grace, Vanguard International Semiconductor, Tower Semiconductor, and Shanghai Huahong. Taiwan, mainland China, and South Korea are clearly the dominant players.Even the slowest-growing foundry, Tower Semiconductor, saw a 19% revenue growth in 2021. Players like SMIC and GlobalFoundries saw revenue growth rates of over 35%. The fastest-growing companies were Samsung Foundry, PSMC, and Shanghai Huahong Grace, with growth rates of 66%, 74%, and 70%, respectively.Gartner noted that Samsung Foundry’s growth was driven by Qualcomm’s 5G chips, Nvidia GPUs, Google’s TPUs, and the strong demand from the mining industry for mining cards. PSMC’s growth was attributed to DDI chips and some of their specialty processes. Shanghai Huahong Grace’s strong growth was largely due to the capacity increase at their Wuxi facility. Gartner also highlighted SMIC’s capacity growth in 14nm processes, which became a key factor in their revenue increase.Despite these strong performances, no foundry is currently in a position to rival TSMC in terms of revenue. TSMC’s revenue in 2021 exceeded $50 billion, while none of the other top 9 foundries surpassed $10 billion. In total, the top 10 foundries’ combined revenue reached $100.2 billion, with an average growth rate of 31.3%, largely driven by TSMC.Counterpoint Research recently released Q1 2022 revenue share data for foundries. The overall situation is similar to last year. TSMC's Q1 2022 report highlighted its growth driven by HPC, including clients like Apple, AMD, Nvidia, and more. It also noted that HPC has now overtaken the smartphone sector to become TSMC’s most profitable application.Notably, the overall growth of foundries is closely tied to the rise in wafer average selling prices (ASP), which has been common in the current chip shortage environment. Many companies have seen significant performance growth during this period, with PSMC being one of the most representative examples.Price trends for different processes According to Counterpoint Research’s data, the process with the highest revenue share in Q1 2022 was the 7nm/6nm process, accounting for 18%. The main chips in this category include smartphone AP/SoC, tablet APUs, GPUs, and CPUs. The second-highest revenue came from 16/14/12nm processes (grouped together as they belong to the same process family), with major revenue from smartphone RF IC/4G SoC, wearable device processors, SSD controllers, and some PC-related ICs.Gartner recently reported on the revenue growth of different processes in 2021. The fastest-growing process was undoubtedly 5nm, with a 198% market value increase compared to 2020. This is the primary process for flagship smartphone AP/SoC chips, as well as applications like Apple’s Mac chips. According to Gartner’s data, 7nm currently holds the largest revenue share among all processes, with a 17% year-on-year growth rate starting in 2021.In 2021, processes like 28nm and 65nm saw relatively fast price increases, partly due to the large demand for MCU and other chips. For instance, 65nm process revenue grew by 48% in 2021 compared to 2020, revealing strong market demand.Revenue from different processes depends on the foundries' investment levels. Gartner believes that the 28nm process currently has significant investment and that its supply capacity will increase substantially in the next few years. SMIC, for example, is planning to build 28nm factories in Beijing, Shanghai, and Shenzhen. The trends for investments in various processes can help predict potential shortages or oversupply in the market.As a cyclical industry, semiconductor manufacturing often experiences various shifts between supply and demand, with growth and decline following cyclical patterns. Semiconductor manufacturing’s response to market conditions tends to be slower. Given that demand is approaching saturation for many chip types, observing the semiconductor manufacturing market in 2023-2024 will reveal a different landscape.

Undoubtedly, when it comes to electronic system design, most people focus on integrated circuits, while the accompanying passive components often go unnoticed. However, the value of passive components should not be underestimated.To ensure that the expected performance requirements are met at the time of delivery, and that the end equipment possesses all necessary functions, passive components integrated into electronic hardware play a crucial role. If a specific component—no matter how small or inexpensive it is—cannot be procured within an acceptable timeframe, it may have a significant impact on the production process of the OEM (Original Equipment Manufacturer). Existing orders may fail to be completed, ultimately missing potential opportunities.The past year and a half has been the most challenging period in the history of the global electronics supply chain. Production disruptions caused by the COVID-19 pandemic have exacerbated the already emerging component shortages.Even before the outbreak of COVID-19, the supply of multilayer ceramic capacitors (MLCC) was limited due to long lead times. Demand had been sluggish through the end of 2018 and early 2019, causing many manufacturers to significantly reduce MLCC production capacity. However, since then, market dynamics have revived demand for these components, which has now reached unprecedented heights.According to a report from Mordor Intelligence, the global MLCC market value reached $10.3 billion in 2020 and is projected to exceed $15 billion by 2026. During this period, the compound annual growth rate (CAGR) of MLCC will be 5.42%. Industries driving MLCC demand include 5G smartphones, electric vehicle (EV) powertrains, and renewable energy generation systems.Electric Vehicles and Applications In the coming years, the number of electric vehicles (EVs) on the roads will increase significantly, helping society reduce carbon emissions (related to climate change) and nitrogen oxide emissions (which harm human health). If predictions by the International Energy Agency (IEA) are correct, by 2030, the number of registered electric vehicles will exceed 145 million. With the widespread adoption of charging infrastructure, charging times for EV batteries will also shorten.At the same time, increasing the voltage of EV powertrains will help improve power, thereby extending the range of the vehicle on a single charge. Although these innovations will help increase the adoption of EVs, the high voltage required will place additional loads on related circuits, necessitating the use of more passive components. Currently, each electric vehicle requires over 10,000 MLCCs, underscoring the massive total demand for MLCCs in the market.5G Mobile Communications To achieve the higher data rates and greater data volumes promised by 5G networks, 5G communication will not only require more stable frequencies but will also use higher frequency bands, particularly in the millimeter-wave region of the radio frequency spectrum. As a result, there will be an increasing demand for higher-value capacitors and lower-loss magnetic components.Internet of Things Infrastructure In the coming years, billions of IoT nodes will be deployed to support industrial automation and smart city solutions. This will drive demand for supercapacitors, which can be used for energy harvesting—to store energy gathered from the surrounding environment by devices such as photovoltaic cells and thermoelectric generators (TEGs). This means that the need to replace batteries—an expensive and logistically challenging task—will be eliminated.Redefining the Passive Component Supply Chain Facing the current shortage of available stock, OEM manufacturers are under immense pressure. They need to find ways to alleviate the supply shortages and shorten lead times for related components. To achieve this, OEMs must work more closely with distributor partners.Looking ahead, the "just-in-time production" culture established in the past decade will no longer be applicable. Instead, engineering and procurement departments within OEMs need to be better prepared to avoid the risk of needing to redesign products due to insufficient components—and the potential financial losses resulting from this.If OEMs have a clearer understanding of mid- and long-term demand for passive components, they can plan more effectively in advance. Additionally, negotiating with their preferred distributors will allow them to stay informed of current industry trends and any potential demand hotspots that could negatively impact the supply of specific components.On the other hand, distributors must leverage their knowledge of the market and key applications to determine where demand may be most urgent. This way, they can ensure their component inventories meet customer needs. If a component is difficult to source, they must use their expertise to suggest potential alternatives.The electronics industry is constantly evolving, keeping up with the times and never standing still. Exciting new applications are emerging, requiring the selection of appropriate components to support these applications.Although most processes focus on high-end active components, the procurement issues surrounding passive components are often the most prominent. The recent shortage of MLCCs faced by OEMs only underscores this point. It also highlights the importance of establishing effective supply channels to address bottlenecks in the component supply chain.